Image by Francesco Ungaro

A different way to buy construction has been used for more than 30 years with good results. Will it catch on in Ireland?

CONSTRUCTION OFTEN GOES BADLY

As a whole, the construction industry performs poorly, most observers and construction professionals agree. It perform poorly for its participants and its customers.

Productivity is part of it. McKinsey reported in 2017 that productivity in the global construction is a third less than in the global economy. The average worker produces $37 (USD) of value; the average construction worker only $25. This gap, multiplied by the number of hours worked in construction across the world, comes to $1.6 trillion a year in lost productivity. Trillion. Every year.

And the gap is getting bigger. General productivity across the world grows at 2.8% per year. Manufacturing productivity at 3.6%. But construction at only 1%. In the United States, construction output per hour worked is less than it was in 1968. Stanford University’s Paul Teicholz and Melbourne University’s Matt Stevens reported the same in 2014. McKinsey says: ‘Europe’s productivity is largely treading water.’

In Ireland, the Central Statistics Office reports that across the economy labour productivity grew by an annual average of 3.4% between 2000 and 2018, to which construction contributed minus 0.07%.

An Economic analysis of productivity in the construction sector reported in 2019 that an hour worked in construction in Ireland (in 2015) produced €22.30 of value, compared with €44.51 in Belgium (whose high productivity McKinsey noted too), €37.60 in Denmark, €33.16 in the Netherlands, €25.90 in New Zealand, and €27.03 in the UK. So Ireland is at the bottom of this pack.

Both KcKinsey and the authors of the Irish productivity analysis (KPMG and Future Analytics, peer-reviewed by TU Dublin) noted the thin and volatile profit margins in the construction industry, often cited as a both symptom and cause of underinvestment in capital and innovation, strongly correlated to productivity. (According to McKinsey, construction’s return on investment is significantly better. Return on investment is in the midrange of industries; return (or margin) on sales is in the bottom quartile.) But—

low-productivity projects with ample change orders and claims can be quite profitable if contract structures allow firms to pass these costs on to customers.

This brings us to how construction performs for customers. Flyvbjerg, Holm and Buhl studied 258 transport infrastructure projects in 20 countries on 5 continents, and found that 9 out of 10 overran budget, by 28% on average. In 2019, the Irish Comptroller and Auditor General investigated 10 capital projects in higher education completed between 2010 and 2015. All 10 overran in cost and time. The total cost overrun was €67.2 million, on average 24% over the tendered price. Completion was 14 months late on average.

In Rethinking Construction, the UK Government task force led by Sir Michael Egan wrote in 1998 that construction underachieved across the board:

Under-achievement can also be found in the growing dissatisfaction with construction among both private and public sector clients. Projects are widely seen as unpredictable in terms of delivery on time, within budget and to the standards of quality expected. Investment in construction is seen as expensive, when compared both to other goods and services and to other countries. In short, construction too often fails to meet the needs of modern businesses that must be competitive in international markets, and rarely provides best value for clients and taxpayers.

Egan said that the best performers had proven that, by modernising, construction companies and projects could reduce both capital cost and time to complete by 10% per year, and increase both labour productivity and construction companies’ profitability by the same annual percentage. But a review of progress 11 years later found that only only half of projects are likely to come in on budget; the other half overran by 26% on average. And in 2011, the UK’s Government Construction Strategy said modestly: ‘The UK does not get full value from the public construction sector.’

MISALIGNED CONTRACT STRUCTURES & INCENTIVES

McKinsey describes 10 ‘root causes’ of poor productivity. (They cause wider problems too.)

Increasing project and site complexities

Extensive regulation, land fragmentation, and the cyclical nature of public investment

Grey economy and potential corruption distort market

Construction is opaque and highly fragmented.

Contractual structures and incentives are misaligned.

Bespoke or suboptimal customer requirements

Design processes and investment are inadequate.

Poor project management and execution skills

Insufficiently skilled labour and supervisory skills

Industry underinvests in digitisation, innovation and capital.

Other reports are broadly in line with this in identifying causes for poor productivity and performance. On the positive side, Lean Construction Ireland’s annual books of cases illustrate strong examples of good practice, particularly at the firm level.

I’m concerned with industry dynamics, especially point 5: ‘Contractual structures and incentives are misaligned.’ According to McKinsey, civil engineering contractors saw this as the biggest problem:

For heavy contractors, suboptimal procurement criteria by public and private owners (focused on reducing initially offered prices and offloading risk) combined with, in some cases, corruption or inexperience among buyers—particularly in the public and residential sectors—have nurtured an environment of misaligned contractual and incentive structures. This has led to hostility and change orders rather than productive and trusted collaboration… contractors and suppliers identified misaligned contracts as the most important root cause of low productivity, while the top root cause cited by owners was inefficient on-site execution

These problems have been recognised for a long time. Egan (whose background was in manufacturing; he was boss of Jaguar) blamed clients, and called on the industry to educate them.

Too many clients are undiscriminating and still equate price with cost, selecting designers and contractors almost exclusively on the basis of tendered price. This tendency is widely seen as one of the greatest barriers to improvement. The public sector, because of its need to interpret accountability in a rather narrow sense, is often viewed as a major culprit in this respect. The industry needs to educate and help its clients to differentiate between best value and lowest price.

Unsafe finished works have also been blamed on the procurement system.

Following the Grenfell Tower tragedy in 2017 in which 72 people were killed and more than 70 others injured, Dame Judith Hackett was appointed to conduct an independent review of building regulations and fire safety. In her final report, Building a Safer Future, she wrote:

The way in which procurement is often managed can reduce the likelihood that a building will be safe. The contracting process determines the relationships, competencies and processes that exist between all the parties in the build and management processes. Procurement sets the tone and direction of the relationships between the client, designer, contractor and their subcontractors, as well as determining the formal specification of the building. Issues at this stage, for example inadequate specification, focus on low cost or adversarial contracting, can make it difficult (and most likely, more expensive) to produce a safe building.

More than three hundred years earlier, in 1683, Sébastien Vauban, Louis XIV’s Commissioner-General of Fortifications and the most prominent military engineer of his time, wrote to his boss, Louvois, Secretary of State for War, complaining that construction work was not being finished and would never be finished because of low tenders from ‘untrustworthy and ignorant’ contractors:

In recent years a considerable number of projects have not been finished, nor will they be finished. This disorder, Sir, is caused by the depressed prices frequently obtained for your work … these cut prices are illusionary, especially as a contractor who is working at a loss is like a drowning man who clutches at straw. In the case of the contractor this means he does not pay his suppliers, cheats everyone he can, underpays his men, getting the worst, not only using the most inferior materials, but quibbling over everything and always begging forgiveness over this and that. Abandon this, re-establish good faith, pay the price of the work and do not refuse a reasonable payment to a contractor who will fulfil his obligations. That will always be the best transaction you will be able to find. (Quoted by PA Tilley in Relationship Contracting: A Strategy for Improved Project Performance)

Success on a construction project usually depends on dozens of bilateral contracts: between the client and consultants, between the client and one or more main contractors, between main contractor and subcontractors and major suppliers, between subcontractors and sub-subcontractors and suppliers down the supply chain. Even if the client has a one-stop-shop design & construct contract with a single contractor, that still depends on dozens of subcontracts down the supply chain.

Unlike the fish in the image at the top of this post, these participants are not aligned. Their contracts should be set up to complete the project, but their incentives are different. All the participants must seek to complete their contracts at minimum cost, maximum return, regardless of how that affects the others’ performance of their own contracts: ‘the attempt to optimize each activity inevitably leads to sub-optimal outcomes for the project’.

PUBLIC WORKS CONTRACTS IN IRELAND

In 2003, the Irish government tried to deal with the narrow problem of cost overruns by tightening-up contracts. Minister for Finance Charlie McCreevy introduced the initiative in a budget statement (mostly remembered for an announcement that government department headquarters would be ‘decentralised’ to provincial towns). It included this:

To complement the new capital envelope system I also intend to introduce significant changes in the areas of public sector contracts for construction and construction-related services. There will be greater use of contracts in which more of the risks of inflation and other cost increases will be borne by contractors and this will ultimately give better value for money to the State.

A focus on transferring risks. An assumption that transferring risks gives the State better value.

According to the Government Contracts Committee for Construction’s Report on the Review of the Performance of the Public Works Contract (2014 and a 2011 interim review), the decision was prompted by average cost overruns of 42% on civil engineering works completed in the period 2000–03. The main factor in excessive overruns was ‘inadequate consideration of risk through the project development stages.’ The solution was a suite of guidance called the Capital Works Management Framework, with fixed price, lump sum contracts as a key component. The committee says that the industry’s response was ‘negative’.

Did the contracts (I drafted the original 2007 versions) and their accompanying guidance realise the expected price increases, cost certainty, and value?

According to the committee, McCreevy expected tender price increases of up to 10% in exchange for the additional risk transfer. But that didn’t happen. The economy collapsed and tender prices fell by as much as 30% from 2006 levels. This was out of line with cost changes: material and fuel costs had actually gone up and centrally-bargained wage levels only fell by 7.5%. And risk transfer wasn’t working because of poor project definition.

With regard to the optional risk transfers, in order for a contractor to price the risk, a comprehensively designed project must be provided along with reasonable levels of information on those risks.

Where a project is poorly defined, which can arise for a variety of reasons, a fixed price, lump-sum contract will not deliver the desired outcome because it is not designed to cater for such circumstances. Where a project is well defined and the contractor adopts a strategy of pricing low, ignoring the risk and attempting to increase the return by claiming back during the course of the contract, contracting authorities are reliant on the dispute resolution mechanisms in the contract. A lack of case law on the court’s interpretation of key conditions of the contract is leading to significant uncertainty for contractors and contracting authorities alike when engaging in dispute resolution under the contract.

The committee referred to a number of problems:

- the ‘commercial strategy of pricing low and claiming additional amounts’ in what had become a very competitive tendering environment

- designers also tendering low fees and then providing poor quality information for contractors to tender and build

- all this resulting in claims, disputes, and poor quality construction.

As for cost certainty and timely completion: limited data would suggest that they are ‘still some way off’. Whether value for money was being obtained could not be ascertained yet.

The post-2007 factors identified by the committee—inadequate project definition, low bidding, conflict—will certainly lead to bad outcomes, with cost overrun just one of the problems. (Case law is beside the point. There isn’t much case law on most standard contract forms, partly because they mainly use confidential arbitration.) But as we have seen, experience and research over many years point to wider issues.

DO WE EVEN NEED CONTRACTS?

Effective partnering does not rest on contracts. Contracts can add significantly to the cost of a project and often add no value for the client. If the relationship between a contractor and employer is soundly based and the parties recognise their mutual interdependence, then formal contract documents should gradually become obsolete. The construction industry may find this revolutionary. So did the motor industry, but we have seen non-contractually based relationships between Nissan and its 130 principal suppliers and we know they work.

For more than 50 years, scholars have distinguished between two types of exchange:

- classical transactional exchanges and

- longer-term, less fully defined arrangements underpinned by trust, solidarity, and reciprocity.

Buying a product over the counter (or from a vending machine) is a simple transaction: goods change hands; money changes hands.It is usually wrapped in a contract. As David Campbell and Donald Harris point out, ‘one does not need a contract to exchange goods – one needs the contract to get a state-underwritten guarantee of a remedy in the event of a breach.’ For example, if it turns out that there is something wrong with the goods; or there is a gap between goods and payment.

Construction contracts are more complex, and less complete. They are performed over a longer period. Some obligations might be undefined, or defined in only general terms, because not all contingencies can be provided for in advance. Lawyers think the contract is all-important, but others have noted that more is going on.

Ian Macneil (1929-2010), a Scots-US contract law professor, and Oliver Williamson (1932-2020), a Nobel economics laureate, wrote that contracts and contract law play a marginal role in these relationships. Parties’ behaviour tends to be characterised by trust, co-operation, solidarity, reciprocity, flexibility, and the desire to continue the relationship. This is not because the parties are good. It is because they have made an investment in the relationship, and have learned that the benefits of the exchange are maximised by co-operating than engaging in individualistic or opportunistic behaviour. Legal remedies are imperfect, costly and unpredictable, and therefore inefficient, so they tend to be used only in extreme cases. Williamson rejected

the assumption, common to both law and economics, that the legal system enforces promises in a knowledgeable, sophisticated, and low-cost way. Albeit instructive, this convenient assumption is commonly contradicted by the facts – on which account additional or alternative modes have arisen.

Litigation risk

Shakespeare’s The Merchant of Venice illustrates litigation risk in a grisly transaction. Shylock thought he had a watertight bond and security for the 3,000 ducats he lent Antonio. When Antonio failed to repay on time, Shylock wanted to enforce his security—a pound of Antonio’s flesh. Portia, disguised as a lawyer, tried for a settlement:

Be merciful;

Take thrice thy money; bid me tear the bond

But Shylock was tired of Antonio’s antisemitic abuse, and in no mood for compromise. ‘Proceed to judgment,’ he said. Then Portia spotted a point. Yes, Shylock is entitled to cut out a pound of flesh; but no more, no less, and no blood:

This bond doth give thee here no jot of blood.

The words expressly are ‘a pound of flesh.’

Take then thy bond, take thou thy pound of flesh,

But in the cutting it, if thou dost shed

One drop of Christian blood, thy lands and goods

Are by the laws of Venice confiscate

Unto the state of Venice.

Portia and Shylock, Thomas Sully 1835

Creative Commons licence CC BY-SA 4.0

Robert Putnam, a US political scientist described social capital, civic culture, and trust in 20th century Italy and their decline in the United States, and their importance in certain business communities. He wrote in 2001:

When economic and political dealing is embedded in dense networks of social interaction, incentives for opportunism and malfeasance are reduced. This is why the diamond trade, with its extreme possibilities for fraud, is concentrated within closeknit ethnic enclaves. Dense social ties facilitate gossip and other valuable ways of cultivating reputation – an essential foundation for trust in a complex society

The weak shadow of the law

Lisa Bernstein, a law professor at Harvard, has studied how John Deere and other equipment manufacturers and parts suppliers in the US mid-west (like diamond, cotton, and grain merchants) use their agreements to gain value in informal, non-contractual, ways. Describing ‘the weak shadow of the law’, she wrote in 2015:

understanding the ways these agreements are governed suggests that their goal is not merely to secure performance of the promises they contain. Rather, and perhaps more importantly, these agreements are artfully designed to create a framework for growing relational social capital and leveraging network governance—a framework that is likely to succeed in creating the conditions that will better enable transactors to identify and bond value-creating exchanges in the future.

Richard Dawkins argued in The Selfish Gene that humans evolved to cooperate because cooperation is a successful strategy. In The Evolution of Cooperation, Robert Axelrod reported the same conclusion using game theory. Computer programmes competed in iterative rounds of the prisoner’s dilemma game. The programme using a predictable, co-operative strategy (tit-for-tat: defecting once in response to every defection) won every time.

Social psychologists and some legal scholars and behavioural economists argue, like Egan, that contracts and incentives do more harm than good: they ‘crowd-out’ voluntary reciprocal cooperation, damaging business relationships. Much of this is more concerned with incentives than contracts. Others, such as economist Benjamin Klein, legal and economics scholar Morton Hiviid, and business professors Laura Poppo and Todd Zenger counter (convincingly, I think) that contracts still have an an important role. Poppo and Zenger argue that contracts and relational governance can complement each other:

Rather than hindering or substituting for relational governance, well-specified contracts may actually promote more cooperative, long-term, trusting exchange relationships. Well-specified contracts narrow the domain and severity of risk to which an exchange is exposed and thereby encourage cooperation and trust.

So contracts can help. But they are less important than most lawyers think. One way of looking at this is the old adage that the contract is best left in the drawer until something really serious happens.

Certainly, contracts can give clarity about who bears the brunt of major risks, and legally-enforceable, although imperfect, remedies. But they can also be set up in a way to recognise and facilitate the importance of relationships; with structure, levers, and incentives that are aligned and seek to foster trust and cooperation, solidarity and reciprocity, collaboration for providing value and reducing waste. Rather than work against that grain.

Relational contract

From this discourse has emerged the concept of a ‘relational contract’. There doesn’t seem to be consensus yet on exactly what that means. Arguments have been made to Irish and English courts that contracts must be performed with good faith because they are relational. Flynn v Breccia [2015] IEHC 547 paras 110-164, reversed [2017] IECA 74 paras 94-104; Quantum Advisory v Quantum Actuarial [2023] EWCA Civ 12 paras 46-49; Candey v Bosheh [2022] EWCA 1103, paras 30-43; Globe Motors v TRW LucasVariety Electric Steering [2016] EWCA Civ 396 paras 67-69 (Beatson LJ obiter); Bates v Post Office [2019] EWHC 606 (QB) paras 702-741; Yang Seng v International Trade Corp [2013] EWHC 11.

REWIRING FOR COLLABORATION

The construction industry and its clients have been trying to improve collaboration for more than 30 years.

In the 1980s, Vauban’s American successors in the US Army Corps of Engineers developed partnering, to reverse an adversarial culture. This involved non-contractual measures such as charters setting out objectives, workshops, team-building exercises, benchmarking, and business process mapping. Partnering was taken up widely in the US and elsewhere. It was supposed to change behaviour without changing the contractual structure. But the term is not used consistently. It sometimes encompasses alternative contractual structures, such as in the project partnering contract suite. Partnering is sometimes used as a synonym for alliancing, which began in North Sea in the early 1990s.

BP: Andrew

In the early 1990s, BP was faced with the challenges of smaller reserves, increasing competition from other drilling locations around the world, an oil price fall to $14 per barrel, and a corporate requirement of 25% return on investment. BP Exploration (BPX) needed to find a way to reduce the cost of developing the geologically complex Andrew oil and gas field in the North Sea down from an unaffordable estimate of $675 million. (It was named Andrew after the saint, not the prince.)

Steven Prokesh writes that the BPX team

began to broaden its thinking and reconsider every aspect of the problem. Instead of looking only at technology for the solution, how about looking at BPX’s relationship with its contractors? How about treating them as allies? How about giving them a financial interest in the project’s success and encouraging them to work together to challenge costs, seek the best value, and innovate

The ‘alliance’ of contractors responded to BPX’s challenge by putting forward an innovative proposal to complete the development for $560 million. It was agreed that the contractors would absorb any cost overruns up to a maximum exposure of $40 million, and would keep more than 50% of any saving if the project came in at less than $560 million.

The project was completed more than 6 months early at an outturn cost just below $444 million.

BP had similar success with this approach – which became known as alliancing – on other oil and gas field and refinery development projects.

Alliancing

Alliancing spread from the North Sea to Western Australia, where the oil and gas industry successfully implemented it starting in 1994, followed by the WA Water Corporation, then other public bodies across Australia and New Zealand, especially on transport and water projects.

By 2009, a third of all public infrastructure spending in Australia was on alliance projects. Alliancing had gone from innovation to business-as-usual procurement for large projects. That year In Pursuit of Additonal Value, the report of a benchmarking study commissioned by the Victorian government, found that alliancing was good for avoiding disputes, improving non-cost outcomes, and starting projects early; but was not giving value for money. Public private partnerships provided most cost certainty (5-10% overrun on business case estimate), then traditional (about 20%), with alliances last (about 50% overrun on business case estimate). The solutions recommended included better business cases; more attention to matching the procurement strategy to the project (rather than defaulting to alliancing); more use of competition (including on price where appropriate) to encourage innovation and efficiency; and clients being better equipped to represent their own commercial interests, with more appropriate legal agreements and better governance.

Alliancing is remains popular in Australia and New Zealand, now used more selectively. The federal government has published National Alliance Contracting Guidelines. They explain:

Risk sharing v risk allocation

The most significant difference between traditional contracting methods and alliance contracting is that in alliancing, all project risk management and outcomes are collectively shared by the Participants. In more traditional methods of risk allocation, specific risks are allocated to Participants who are individually responsible for best managing the risk and bearing the risk outcome. This concept of collective risk sharing provides the foundation for the characteristics that underpin alliance contracting including collaboration, making best–for– project decisions and innovation. If substantial and significant risk is allocated to individual Participants, then it may not be an alliance and those characteristics may not be necessarily required or appropriate.

A 2019 Comparative Analysis of Alliancing and Public Private Partnership Cost Performance in Australasia Infrastructure Projects reported that data from 48 completed projects showed alliancing outperforming PPP on 3 cost certainty metrics: growth from bid to contract price (alliancing +4.63%; PPP +10.30%); change orders (alliancing: -7.67; PPP: +1.16%); and importantly the amount by which the final out-turn cost exceeded the client’s pre-bid estimate (alliancing -3.39%, PPP +11.58%). This is interesting because PPP is more inflexible than alliancing or traditional contracting. The focus is on certainty rather than collaboration and innovation. A very highly structured (and highly lawyered) suite of contracts transfers more risk than traditional contracts to the private sector partner, and down its construction supply chain. If PPP contracts work as intended, they should give the highest cost certainty.

Finland adopted alliancing for a number of pilot projects, consciously building on the Australian experience. The Finish Transport Agency reports success in using alliancing for a €104 million renovation of the 90 km Lielahti–Kokemäki railway (said to be the first [public works] alliance in Europe); and the €185 million Tampere onshore road which includes a 2.3km double tunnel—the longest in Finland. It is reported that this project achieved a 10% cost reduction in the joint development phase, and the outturn cost underran the €180 million target, with completion 6 months early (on a tight programme). Finland has also used alliancing on some smaller completed building projects. This shows that the alliancing model can be used in an EU member state country that, according to one commentator

seems to have been more conservative (so far) in the application of the European [procurement] directive and its economically more advantageous criterion than some other countries governed by the same directive.

The Hackett report on fire safety cited the Finnish example as ‘lessons on working together with industry to drive a culture of responsibility.’

Alliancing has been taken home to the UK by clients including British Gas, Network Rail, and Highways England. HM Treasury and the Infrastructure Client Group reported in 2014 that the latter (previously called the Highways Agency) had saved £1 billion across all its alliances.

The UK’s most recent central Government guidance, the Construction Playbook, promotes alliancing somewhat cautiously and selectively:

Experience shows that while alliancing arrangements are not always appropriate, they should be considered on more complex programmes of work as the effective alignment of commercial objectives is likely to improve intended outcomes as well as drive greater value for money. Alliancing models also provide more effective integration, which leads to effective and aligned arrangements, and enables engagement with the wider supply chain and platform delivery.

Strategic alliancing

The British water industry embraced alliancing enthusiastically, moving towards multi-project, strategic alliances covering entire programmes of projects, linked to utilities’ periodic regulatory commitments. In the mid-1990s Thames Water found that its method of procuring capital works was adversarial, expensive, wasteful, unpredictable, and lacking in innovation. It adopted a ‘strategic’ alliancing approach, involving whole programmes. Reported benefits include a 20-30% reduction in procurement effort; minimal claims; improved cost predictability (costs typically 5% below target); improved responsiveness and reduced overall project time; more innovation such as off-site pre-fabrication; more learning and idea sharing; improved recruitment, training, and retention; and better planning, design and performance.

Anglian Water: @one Alliance

Anglian Water is a regulated water utility serving Eastern England, and defines its capital spending in 5-year regulatory cycles (about £4.5 billion per cycle). For the regulatory period 2015-20, Anglian committed to a significant reductions in capital costs, time on site, and embodied (that is, construction phase, including transport) and operational carbon emissions. Anglian turned to its @one Alliance with 6 key contractors, launched in 2005. The alliance works as an virtual organisation, to which each of the partners sends secondees, performing the role of integrator. Both the alliance (in which Anglian Water and the main contractors participate) and its framework suppliers make their return by making improvements on historic benchmarks. The commercial structure was modified as the alliance progressed, for example by removing the link between individual return and turnover, and reducing the client’s share of the gain pool. These changes led to improved results.

Collaboration over a long term has led to development of standard products, which was the main driver of annual savings of 2 to 3% while increasing quality of service and reducing embodied carbon by 54% from 2010 to 2015, operational carbon by 41% in the same period, and workplace accidents from 1 accident per 300,000 hours worked to 1 per million.

This alliance is described by David Mosey in Collaborative Construction Procurement and Improved Value pp 77-78, by Boston Consulting Group in a case study for the World Economic Forum, and by Charles Jensen in another case study for the Institution of Civil Engineers.

December 2021 saw publication of Constructing the Gold Standard, David Mosey’s independent review of public sector frameworks for the UK Cabinet Office. Mosey noted that frameworks are often used as a shortcut to market, but should be used more strategically to realise the objectives of the Playbook. He recommended a ‘gold standard’ for frameworks, noting that many of its features are reflected in alliancing arrangements.

Integrated project delivery

In North America alliancing has been developed into integrated project delivery (IPD). A 2012 series of case studies by the University of Minnesota identified the following ‘markers’ of IPD:

- relational contracts

- protection from litigation

- aligned project goals (jointly developed project target criteria)

- informed and balanced decision-making (collaborative decision making)

- open communication

- risks identified and accepted early

… and the following IPD ‘strategies’

- key participants bound together as equals (multi-party agreement)

- budget & create team for design intensive work

- early contribution of expertise (early involvement of key participants)

- pre-existing relationships between parties

- champion/ facilitator (leadership by all)

- shared financial risk and reward based on project outcome

- liability waivers between key participants

- fiscal transparency between key participants

- BIM – virtual rehearsal of construction and ongoing constructability reviews

- Lean construction processes

- Co-location

To date, IPD has been used successfully in building projects, notably hospitals.

Sutter Health

Sutter Health is a healthcare provider in Northern California with 24 acute hospitals and dozens of other centres, and an annual capital spend of about $700 million. Between 2007 and 2019 it completed 25 projects at a cost of $4.7 billion (in 2019 dollars), completing them on average 5% under budget. All but 2 were completed at or under budget and on time or early —using the original business case budget and programme as the baseline comparator. One was slightly late and one was slightly over budget. Scope was not compromised on any of the projects

Sutter’s Digby Christian explained in a Lean Construction Ireland webinar how this was done.

Sutter identified the need for clarity and alignment on what was required and what success means, and uses a host of methods, of which the 4 most important are:

clear value definition (what the project is trying to achieve) and conditions of satisfaction (scope required, time available, money available, other imperatives). Sutter Health does this, before business case approval, with a validation study: a detailed document, more than 400 pages for a complex project, costing 1-2% of the project budget.

a ‘smart’ (IPD) contract with shared risk and reward and shared governance (discussed below in more detail)

intentionally managing culture to promote collaborative behaviour. This includes (a) creating a psychologically safe environment (where, for example, respectful challenge is encouraged and breakdowns are quickly acknowledged and corrected); (b) using the Last Planner® system; (c) requiring leaders to model expected behaviours.

using visuals (including the works) to drive conversations about important matters on, for example, clashes, programme, budget

At the start of this post we looked at two reports on construction productivity. They see these developments in improving collaboration as key to the fix.

KPMG/Future Analytics/TU Dublin’s recommendations are underpinned by 3 ‘high-level principles’. The first is:

A collaborative and mutually supportive relationship between clients and delivery partners that promotes and fosters:

full lifecycle thinking across the sector

leadership and timely decision making

efficient processes and a productive work environment that minimises waste, carbon emissions and enhances the circular economy.

One of the specific recommendations included:

Explore opportunities for more integrated project delivery with early engagement of all stakeholders involved in the delivery of a project. This will support clearer communication on all aspects of delivery from design through to build and handover.

McKinsey proposed 7 ways to improve productivity. The second is: ‘rewiring the contractual framework to develop a genuinely collaborative approach to construction projects.’ (I borrowed the title of this post from McKinsey.) Under this head, McKinsey made 3 sets of recommendations:

First, improve the process for appointing contractors. This includes more thorough suitability assessment; and more systematic identification and prioritising of risk, allocating each risk to its ‘natural owner.’ For example, the client is typically the natural owner of the risk of scope changes and site conditions. McKinsey also supported 2-stage negotiation of pricing, which can save 7-15% of contract cost by allowing bidders’ adjust their commercial offers in response to economic feedback.

Second, McKinsey suggested ways of fostering a collaborative culture outside the contract, such as ‘overinvesting’ in up-front planning and scoping, devoting resources to managing integration and interfaces, ensuring that there one ‘source of truth’ (or common data environment in BIMspeak) for drawings, programmes, KPIs etc. This requires investment in digital platforms and solutions and well-structured and fact-based performance reviews. And learning: involving contractors to discuss, for example, possible scope changes, standardised designs, use of innovative technologies.

McKinsey’s third suggestion was to structure the contract to best support collaboration. With traditional contracts, incentive programmes should be added. They are more effective if they are designed in cooperation with contractors and attractive enough to give contractors a stake in the project’s outcome. The arrangement must be self-funding, and additional profits and savings must be shared with contractors. Incentives must be carefully designed to avoid unintended consequences, such as shortcuts that reduce quality. They must reward project outcomes, not individual outcomes at the expense of other participants. Going beyond this, clients should use alternative contracting strategies to institutionalise collaboration

‘

The UK Government has embraced some of this thinking. Although its most recent Construction Playbook (September 2022) suggests using alliancing selectively, its policies include:

- longer-term contracts and frameworks across ‘portfolios’ of projects

- early supply chain involvement on all public works projects

- clear specifications

- standard form contracts and framework agreements, structured to support an exchange of data, drive collaboration, improve value, and manage risk

- on risk management:

Conduct meaningful engagement with the market. Set a collaborative tone and provide clear escalation routes for suppliers.

Risk should be allocated to, and managed by, those best able to bear and manage them (this includes the contracting authority). Contractual allocation should reflect the extent to which parties are responsible for risks and their management.

Contracts should be designed to be profitable and offer a fair return for the market to be sustainable. It is good practice to test profitability under different circumstances and make use of the Should Cost Model in developing payment mechanisms.

The payment mechanism and pricing approach including limits of liability should reflect the level of risk and uncertainty in the scope of requirement and will be subject to greater scrutiny.

When a contract is publicly designated as onerous, it should prompt a root cause analysis and conversation with the supplier.

A CLOSER LOOK

Here we look 6 features of collaborative arrangements. They are:

- long term relationship contracts that are bigger than one project

- early involvement of contractors and other key supply chain

- one contract bringing together all the key participants

- shared risk and reward based on project outcome

- shared decision making

- reduced liability exposure

Many successful collaborative arrangements have some of these features. Even the most advanced of full-on alliancing or IPD arrangements might not have them all. We can see them as tools, to be considered for any project or programme.

Long-term relationship

Egan pointed out the value of long-term relationships, referring to long-term alliances:

An essential ingredient in the delivery of radical performance improvements in other industries has been the creation of long term relationships or alliances throughout the supply chain on the basis of mutual interest. Alliances offer the co-operation and continuity needed to enable the team to learn and take a stake in improving the product. A team that does not stay together has no learning capability and no chance of making the incremental improvements that improve efficiency over the long term.

We have already looked at this, in the context of strategic alliances and frameworks. A alliance or framework contract can add a structure to a relationship, incentivising optimal performance across a series of projects. As Mosey pointed out, frameworks can be much more than a procurement shortcut for public bodies and utilities.

The benefit of repeat work and relationships to collaboration and efficiency are obvious. But many construction projects, especially large and complex ones, are one-off. There are many success stories of single-project collaboration.

Early involvement

If there is to be price competition, there is a tension in deciding when to appoint. The more developed the design, the greater the scope for using robust price competition to pick participants. This must be considered on a case by case basis. Bringing contractors and suppliers on early may mean that price competition is unrealistic, or must be limited to parts of the offering. Selecting them late may facilitate robust price competition but miss opportunities to take advantage of their contributions. We will come back to this.

The procurement process also needs to be related to the parallel tasks of planning and environmental consents. On the early contractor involvement model discussed above, a design and construct contractor is selected before the planning process is complete. The Dutch Ministry of Transport has used this approach for road projects, where a competitive dialogue procurement process is interwoven with the planning process so that they can inform each other.

One contract

Traditionally, the supply chain is bound to the project through a network of bilateral contracts. A single contract for the main participants — or at least the client, lead designer, and main contractor — can provide clarity and alignment. It can be a vehicle for the next two points: shared risk and reward and shared decision making. It can also bind all the key participants to common protocols for other specific matters, for example for building information modelling and inspection.

Shared risk and reward based on project outcome

We have seen discussion of how the traditional commercial model for construction incentivises optimising individual performance, not project performance. Alliancing and IPD contracts have a commercial structure designed to create, encourage, and reward behaviour that delivers value for the project.

Instead of the traditional fixed prices or rates, the payment model in alliancing and IPD contracts usually use a target cost approach. Actual project cost (under defined headings) is reimbursed. Site overheads might be reimbursed or compensated by a fixed fee (or perhaps a percentage). Profit and corporate overheads are compensated by a fixed fee, which is adjusted upwards or downwards based on whether the client’s specified project outcomes are met. These outcomes will include a target outcome cost, and can include other indicators such as timely completion, safety, carbon emissions, and so on.

On this model, the supply chain (designers, contractor, key subcontractors and suppliers) is guaranteed reimbursement of cost, but all profits are placed in a pool which is paid only to the extent the project achieves the specified outcomes. If outcomes are exceeded, for example if the project comes in below the target outcome cost, the gain is shared. Each key participant gets a specified percentage of the ultimate profit pool.

We will see how collaborative models can accommodate fixed pricing.

Shared decision making

The participants can share their fates because they have a share in control by collaborating in decision-making.

Instead of the traditional arrangement giving the client’s representative control over everything, alliances are usually governed by a core group (or project management team or some such) on which all the key participants are represented.

Decisions are made unanimously where possible, with certain decisions reserved to the client.

Not all decisions are shared. The goals for the project are the client’s goals. In the early stage the participants jointly work out and validate a solution to achieve those goals. Then, as issues arise in the course of the project, the parties commit to working together to resolve them.

Reduced liability exposure

Dispute avoidance has been a particular success of alliancing.

A UK Alliancing Code of Practice (2015) includes as a ‘key principle’ in alliancing agreements: ‘A no blame –no dispute approach (wilful default being the only direct route to legal process). Australian alliancing contracts frequently include ‘no dispute’ clauses that waive almost every kind of claim, excepting ‘wilful breach’ and other limited exceptions. The 2009 benchmarking study of 46 Australian alliances found none that had led to disputes not resolved within the alliance and without recourse to third parties.

Collaborative contracts try to shift focus from fault attribution to joint responsibility for errors and poor performance, and for their consequences and resolution.

While this is often stated as a ‘no disputes’ commitment, if it has substance in contractual terms it takes the form of reduced liability exposure. The payment mechanic is part of this. The parties share the risk and reward associated with the cost of completing the project within the required time, so that it meets the specified performance criteria and other required outcomes. The focus is not on who is to blame if these outcomes are not achieved, or if they cost more than was expected to achieve. The focus is on effort to achieve the agreed goals.

Defects are an example. In target cost contracts defects rectification before completion is often treated as part of the reimbursable cost; fewer allow reimbursement for rectifying defects after completion.

CONTRACT FORMS

Bespoke contract forms are sometimes used for alliancing, IPD, and other collaboratve arrangements, but there are standard forms for both strategic alliances and individual project contracts.

In Ireland, early contractor involvement with two-stage tendering has been used with the NEC3 Engineering and Construction Contract, which has a target cost option, and a modified Public Works Contract. The Capital Works Management Framework includes a Public Works Contract for Early Collaboration, PWCEC, to be used on large projects and only with permission from the Government Contracts Committee for Construction. It does not seem to have ever been used.

The NEC4 suite has specific provisions to encourage and enable collaboration, and optional clauses for early contract involvement (X22) and multi-party collaboration (X12). There is also an NEC 4 Alliance Contract, which is a multi-party contract.

Other project collaboration contract forms published in the UK include the JCT Constructing Excellence contract (CE2016) and Project Partnering Contract (PPC2000). The latter is a multi-party contract for, in essence, a project alliance. PPC2000 has been used by UK public and private clients for authorities for prisons, housing, education facilities, hospitals, hotels, and offices. The Framework Alliance Contract (FAC-1) facilitates frameworks with the character of alliances, with any form of contract used for call-off packages.

In North America, there is are at least 2 standard form multi-party IPD agreements published by industry bodies in the US (ConsensusDocs 300 and AIA C191:2009) and one in Canada (CCDC 30) plus one published by the law firm Hanson Bridgett.

In Collaborative Construction Procurement and Improved Value, David Mosey describes in detail how several specific standard forms support collaborative procurement.

OPPORTUNITIES, RISKS, DILEMMAS

A client planning a project, and considering using some of the collaborative tools, will have concerns about departing from the tried and tested (to failure?) path. The concerns might include these 5:

- What? No fixed price?

- Reducing liability recourse?

- How do I use competition to get value for money?

- Give up control?

- Is my project suitable?

Fixed price

For most clients, the idea of an uncapped cost-reimbursement contract is daunting.

Some clients (and their funders) will want the opposite: the holy grail of a construction ‘wrap’: a contract guaranteeing completion within a fixed time for a fixed (or guaranteed maximum) price with a high degree of recourse to the contractor if that fails to happen.

As we have seen, the traditional arrangement is not good at bringing this about, for a host of reasons. Experience tells us that getting the job complete to the required quality, at the required cost, within the required time depends on effort, and that changing the structure to realign incentives can help bring about the application of that effort — perhaps better than an imperfectly-enforced contract.

Nonetheless, some clients and funders will not want to retain (on paper) the risk of the an out-turn cost exceeding their budget, and will want the paper to transfer that risk to a contractor. They will want the wrap.

For investors and lenders, this paper, preferably with a legal due diligence report favourably assessing it, gives value to the asset before it is built. It can be used to sell or rent the asset, or to raise or sell debt secured by it. In the language of Katharina Pistor’s The Code of Capital: How the law creates wealth and inequality, the paper ‘encodes’ the project, the still-unbuilt asset, as capital. (Mentioning Pistor gives me an opportunity to acknowledge that she reminded me of Shylock’s unsuccessful attempt to enforce his security.)

In Collaborative Construction Procurement and Improved Value, Mosey points out that a collaborative model can give a fixed price. He gives real-world examples. He argues that a 2-stage open book process gives a more credible fixed price than single-stage closed book tendering. At pages 306-07 he writes:

To build up agreed costs with a common understanding of the factors affecting those costs, and then to establish a point in time when they are translated into a fixed price, offers a major step forward in collaborative procurement and provides all team members with a common understanding of costs that is a world away from the uninformed gambling inherent in lowest price arm’s length bids. If established through the collaborative development of cost data and supported by suitable incentives, the agreement of a ‘guaranteed maximum price, working to agreed margins with full open book accounting procedures in place’ is a model that ‘builds trust, helps to overcome the adversarial approach to construction and leads to rapid conflict resolution.’ An informed fixed price can also create a high incentive to complete the the job as efficiently as possible with high productivity.

Reduced liability

A second element of the ‘wrap’ that clients traditionally want is recourse to a well-resourced contractor if something goes wrong. It’s what due diligence on the paper looks for.

At odds with this is the insight that reducing liability exposure can increase communication, foster creativity, and reduce excessive contingencies. On this thinking, many space industry contracts include reciprocal waivers of liability. Together with insurance, they are a legal requirement for launches licenced under the US Commercial Space Launch Competitiveness Act. 51 USC §50914.

But many construction clients are wary of this part of the collaborative model. The Minnesota study of 12 IPD contracts in the US found that only 3 included even limited liability waivers.

Clients looking to secure the benefits of reducing liability recourse will want to consider other ways of protecting their investment, such as insurance.

Competition and value for money

Whether there is a fixed price or some other pricing mechanic, most clients will want to use competition in some way to obtain value for money. Public sector clients and certain utilities in the European Union must do so for most works, supplies, and services contracts and frameworks.

A target cost payment mechanism can accommodate price (and other) competition.

As we have seen, early involvement of the supply chain involves a tension. There is a logic to the Capital Works Management Framework — define the project well with a complete design and high-quality information, and seek competitive fixed price tenders. For any tendering to work properly, bidders must know what they are bidding for. The more work that has been done on design, the more credible the competition. But if the design is complete when the supply chain arrives, opportunities for them to contribute may be lost.

Experts debate (pages 63-66) whether competition harms collaboration, and the UK 2015 Alliancing Code of Practice recommended:

Direct competition between teams, such as being required to price or bid for elements of work against each other, has to be avoided. Collaboration and completion do not co-exist. (Page 36)

But it didn’t mention Victoria’s 2009 benchmarking study of 46 alliances, which found no evidence that such price competition erodes trust or contributes to underpricing risk, and little evidence that it limits innovation. The cost of establishing the target outturn cost through a competitive process was less (about 2%) than simply negotiating it. Also, target outturn costs established using price competition were 5-10% less than purely negotiated ones. Price competition contributed to the target being lower in the following components: on-site overheads, profit, design costs, and target outturn cost development cost. Finally, according to the study, price competition did not reduce client satisfaction with the outcome of the project

Australia and New Zealand have embedded competition in some of their alliances, and Australia’s National Alliance Contracting Guidelines illustrate a number of options.

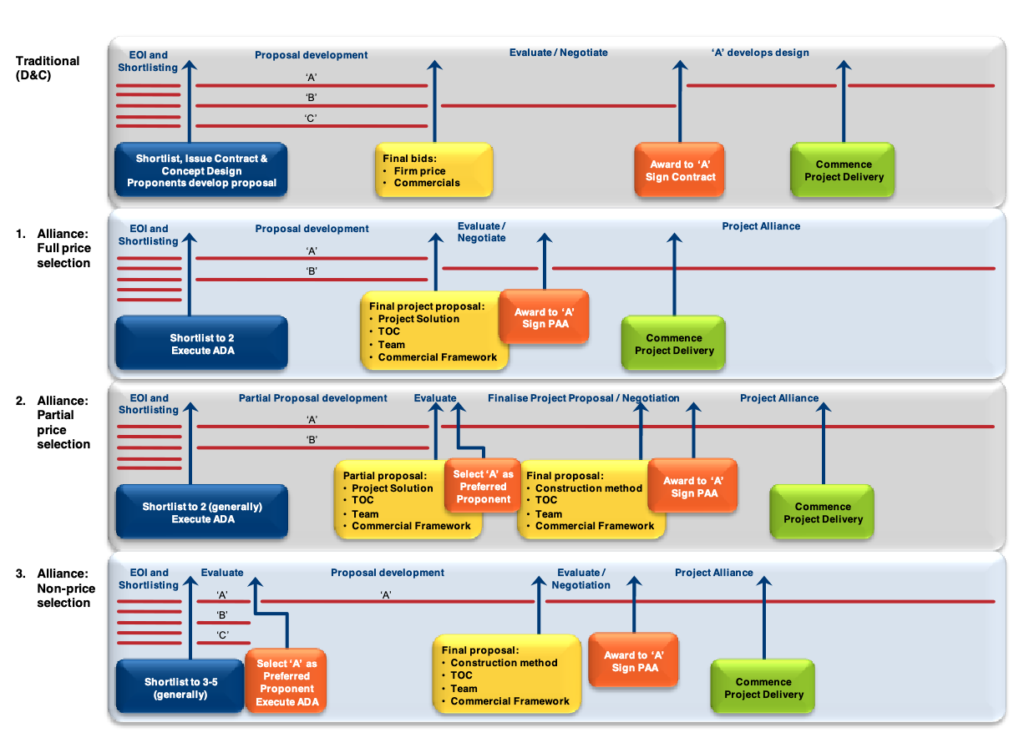

© Commonwealth of Australia 2015, National Alliance Contracting Guidelines – Guide to Alliance Contracting

Creative Commons licence CC BY 3.0 AU

The generally regarded traditional route, design-bid-build, is not even shown here. The top line shows tendered design and construct, with some pre-tender engagement with the shortlisted bidders on concept design. Ireland uses this route for many large infrastructure projects.

The next line, alliance option 1, shows an alliance based on a competitively tendered target outturn cost (TOC). Competing teams are awarded pre-construction alliance development agreements (ADA) and then develop their proposals, and tender the target out-turn cost (TOC) as well as other commercial and technical elements. The winner is awarded a project alliancing agreement (PAA) to complete the project. The tendered target outturn cost is at the centre of the risk and reward share in the project alliancing agreement.

To implement this model under EU procurement law, the alliance development agreements could be awarded in a competition, perhaps as a single-project framework. The award criteria for that competition could include some pricing element, such as rates for certain work or pricing for elements that have been designed, as well as overhead components and a profit. The project alliance agreement would then be awarded as a call-off contract following a mini-competition within the framework.

In alliance option 2, competing teams are awarded alliance development agreements, but only take their proposals to partial completion, following which a winner is selected and awarded a project alliancing agreement, under which the final proposal is developed on the basis of the tendered proposals. If the proposal is not completed, there should be an opportunity to go to the losing semi-finalist. Again, mapping this model onto EU procurement law would treat this as a call-off in a framework.

Alliance option 3 probably matches the most common form of early contractor involvement. After a tender competition, one winner is awarded an alliance development agreement, under which its proposal is developed and, if agreed, a project alliance agreement is awarded.

Shared decision making: governance

Collaborative decision making gives the client less immediate control than traditional contracts, under which the project is ruled by an architect, engineer, or project manager appointed by the client. Sharing control is a trade-off for sharing risk and more productive participation by all. But the client still retains considerable control. Certain decisions are reserved to the client. Others must be made unanimously by all parties, including the client. If unanimity is not possible, then there can be a resolution process.

It is for the client to decide, when setting up the rules, what it wants to control. But as in any contract, if the client has power to change the deal, and uses that power, it must pay—for example by a target outturn cost increase.

The collaborative arrangement leads to another potential governance concern: capture. Australian auditors (page 60) have commented on the risk of the parties getting too close, and the guidelines recommend separating the role of the client as a member of the alliance from the client as the alliance’s customer (‘the owner as owner’), with separate people or teams performing these roles if possible (pages 69-70).

Suitable projects and programmes

The Australian guidelines (chapter 3) recommend two threshold issues before alliancing is considered for a project.

- The project value should normally exceed A$50 million. This is because of higher initial start-up management costs. By comparison, in Ireland, use of the Public Works Contract for Early Collaboration is for ‘large projects (e.g. over €100 million)’.

- The client should have sufficient internal resources with the capability to represent and manage its interests.

Beyond these threshold issues, alliancing can be considered when at least one of the following characteristics is present:

- The project risks cannot be well defined at the time of tendering.

- The cost of risk transfer is likely to be prohibitive.

- An urgent start is required (and worth trading-off for higher cost, and recognising that an early start with incomplete information does not always lead to early completion).

- Because of its particular capabilities, the client needs to participate actively in delivering the project solution. For example the asset being delivered may be part of a broader network about which only client has the necessary knowledge.

- Optimum value for money will be achieved by the project solution being progressively refined and developed to reflect emerging risks and opportunities.

UK guidance says that alliancing is not likely to be effective when certainty of price or time is the overriding requirement or when the required changes in culture and behaviour are unlikely. However, one of the reasons the Finnish Transport Agency used alliancing for the Tampere project was that it ‘expected the alliance model to provide certainty in cost management and acceptability’.

Finally, as we have seen, long-term alliances can bring value to multi-project programmes. But many clients have a one-off project, which can also benefit from collaborative tools.

SMALL STEPS IN IRELAND?

Private sector clients and some commercial semi-state bodies have a good deal of autonomy in buying construction. They can use whatever collaborative tools they think appropriate for their projects. But publicly funded projects have to use the Public Works Contracts and the rest of the Capital Works Management Framework. So far there has been zero appetite for PWCEC, which requires special permission.

There have been a few trial projects using collaborative models, such as road projects using target cost and early contractor involvement. But not many. And many are target cost in name only, with the contractor taking 100% of overruns in excess of a fairly narrow margin — in essence a guaranteed maximum price.

The Capital Works Management Framework advocates some of the steps that would improve outcomes. One is to ensure that projects are fully defined (and fully designed if employer-designed) before tender. Another is to pay close attention to risk, and to how residual risks are managed and allocated; setting up contracts to transfer to contractors only the risks that they can reasonably understand, price, and take on. A third is to be more attentive to unrealistically low bids. More guidance on this would help.

Going beyond that, framework agreements, be they for programmes or even single projects, could provide a structure for honest technical and commercial early dialogue, even in a still-competitive environment, leading to agreement which both parties fully understand, commit to, and believe.

That would be a start.